David Graeber’s Debt: The First 5,000 Years was published in summer 2011. In August-September of that year, he took part in the first New York City General Assembly that formed the Occupy Wall Street movement. Much of the contemporary world revolves around claims we make on each other and on things: ownership, obligations, contracts and payment of taxes, wages, rents, fees etc. David addressed these through a focus on debt in broad historical perspective. It is a central issue in global politics today, at every level of society. The class struggle between debtors and creditors to distribute costs after the long credit boom went bust in 2008 is universal.

David held that the social logic of debt is revealed most clearly when money is involved (Hart 2012). Following Nietzsche, he argued that money introduced the first measure of unequal relations between buyer and seller, creditor and debtor. Indeed, one school of thought holds that “money is debt”. This includes the French and German traditions. Money was always both a commodity and a debt-token, giving rise to much political and moral contestation, especially in the ancient world. Whereas Rousseau traced inequality to the invention of property, he located the roots of human bondage, slavery, tribute, and organized violence in debt relations. The contradictions of indebtedness, escalating class conflict between creditors and debtors fed by money and markets, led the first world religions to articulate notions of freedom and redemption, often involving calls for debt cancellation.

The book contrasts “human economies” with those dominated by money and markets (“commercial economies”). These societies are not necessarily more humane, but “they are economic systems primarily concerned not with the accumulation of wealth, but with the creation, destruction, and rearranging of human beings”. They use money, but mainly as “social currencies” which maintain relations between people rather than being used to purchase things.

“In a human economy, each person is unique and of incomparable value, because each is in a unique nexus of relations with others”. Yet money forms make it possible to treat people as identical objects in exchange and that requires violence. Brutality is omnipresent. Violence is inseparable from money and debt, even in the most “human” of economies, where ripping people out of their familiar context is commonplace. This is taken to another level when they are drawn into systems like the Atlantic slave trade. Slavery and freedom — a pair driven by a culture of honour and indebtedness — culminate in the ultimate contradiction of modern liberal economics, a worldview that conceives of individuals as being socially isolated.

David Graeber then organizes the world history of money in four stages: the first urban civilizations; the “axial age” of world religions; the Middle Ages; and “the great capitalist empires” that ended in 1971 when the US dollar abandoned gold. Money oscillates between two broad types, “credit” and “currency” (bullion), between money as a virtual measure of personal relations, like IOUs, and as impersonal things made from precious metals. The recent rise of virtual credit money may indicate another long swing in money’s central focus. Ours could be a multi-polar world, more like the Middle Ages than the last two centuries. It could offer more scope for “human economies” or at least “social currencies”. The debt crisis might provoke revolutions. Perhaps the institutional complex based on states, money, and markets (capitalism) will be replaced by forms of society more directly responsive to ordinary people and their reliance on “everyday communism”. David’s historical vision has no room for a Great Transformation in the nineteenth century.

Most anthropologists of the last century conceived of a world safe for fieldwork-based ethnography; another minority interest co-existed with this. I call this “the anthropology of unequal society”. Rousseau’s Discourse on Inequality (1754) launched modern anthropology as the critique of unequal society. Morgan (1877) and Engels (1884) were heavily indebted to him when they reconstructed human history as the evolution of society from a kinship matrix to states based on class divisions. This genre was continued by Lévi-Strauss (1949), Sahlins (1958) and Wolf (1982), but with less explicit political content. Overlapping the millennium, its main exponents have been Jack Goody (1976, 2013; Hart 2006) and David Graeber (2011).

Goody sought to undermine Western claims to superiority over the main Asian societies. He downplayed the industrial revolution that allowed Europeans to take over the world in the nineteenth century. Following Braudel (1975), Goody (2013) preferred to point to the similarities between industrial capitalism and the “merchant cultures” of pre-industrial civilizations. He claimed that Marx (1867) misread merchant capitalism, but did not address his case for treating industrial capital as strategic. Weber (1922) too gets short shrift for suggesting that modern capitalism differs from its predecessors. Given their common origins in the Bronze Age urban revolution, modern European capitalism diffused faster to Asia than the Italian renaissance to Northwest Europe.

Despite a barrage of propaganda telling us that we now live in a modern age of science and democracy, our dominant institutions are still those of agrarian civilization — territorial states, embattled cities, landed property, warfare, racism, bureaucracy, literacy, impersonal money, long-distance trade, work as a virtue, world religion, and the nuclear family (Hart 2002). The rebellion of the bourgeoisie against the Old Regime was co-opted by “national capitalism” in a series of political revolutions of the 1860s and 70s (Hart 2009). This severely set back humanity’s emancipation from inequality. Consider the shape of world society today. A remote elite of white, middle-aged, middle-class men, “the men in suits”, rule masses who are predominantly poor, darker, female, and young. The rich countries, who can no longer reproduce themselves, vainly try to stem the inflow of migrants. Our world resembles nothing so much as the Old Regime in France before the revolution (Tocqueville 1859). Goody may have a point in asking us to reconsider how exceptional our societies are.

I have taken part in a conference and book, Debt in the Ancient Mediterranean and Near East (Weisweiler 2022), which was inspired by David’s Debt book. He drew attention to the political economy underpinning a sequence of ancient empires in western Eurasia from the Persians and classical Greeks through Alexander’s conquests to republican and imperial Rome and the Arab conquest of the Mediterranean. Its logic hinged on the need to provision vast armies on prolonged marches. That meant using precious metal coinage, sustained by a network of mines, states and mercenary soldiers, then converting conquered peoples into slaves to be sold for the money needed to complete the cycle. There seems little doubt that western empires from 1500 to 1800 relied on a similar logic. But they were unable to take over the world until industrial capitalism raised their technological competence to a far higher level than the rest.

Marxists and liberals agreed that a world-change was taking place in nineteenth-century Britain. Hegel’s (1821) historical model, however, was very different from Marxism’s successive stages (from feudalism to capitalism to socialism). His three phases were based on the family and the land, the market economy of urban civil society and the modern state respectively. These now co-existed under the coordinating guidance of the state. Both Polanyi (1944) and Marx missed the revolutions of the 1860s and 70s that installed a new class alliance in the leading countries, the partnership between capitalists and the traditional enforcers that I call “national capitalism”. This new alliance soon spawned the legal conditions for modern corporations, as well as a massive expansion of state property and a bureaucratic revolution at all levels of the economy. Mass production and consumption was the result.

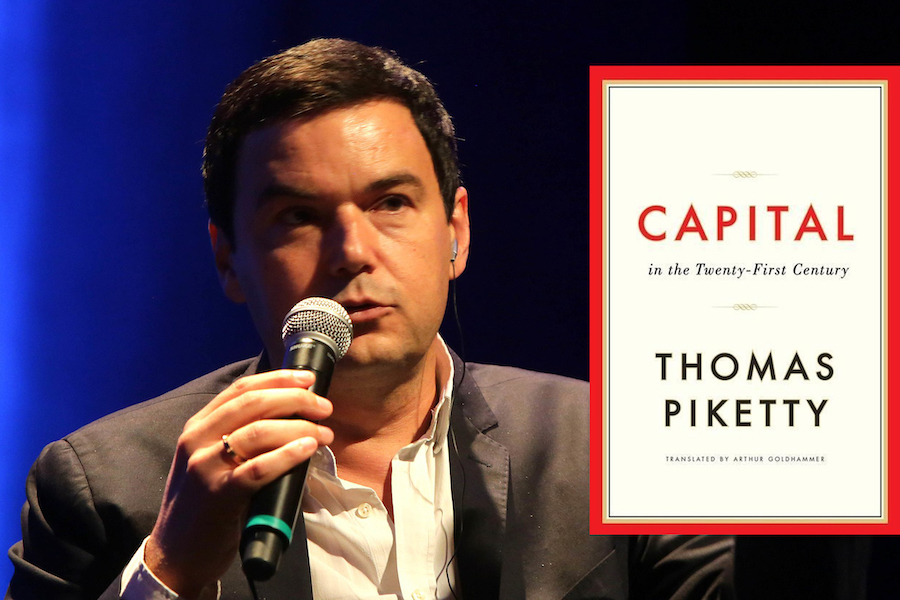

Thomas Piketty’s (2014) book on capital was the smash hit of our times. It was based on serious economics, up to two centuries of national income accounting for a few rich countries. An economist who can quote Balzac can’t be all bad. I identify three reasons for his success. First, Piketty brought inequality back onto the mainstream agenda, just as Occupy Wall Street did — “we are the 99 percent”; and this touched a nerve after three decades of neoliberal responses to the financial crisis that included bailing out the rich and making the poor pay. Second, Piketty’s argument rests on two simple equations describing the relationship between capital and labour over the last 200 years; he uses these to demonstrate that capital’s share of national income must always increase. It is unlikely that teeming historical diversity can be captured by timeless categories and equations. Third, against the notion that capitalists make their money by producing competitively for profit, Piketty claimed that property was a growing component of wealth; inheritance and rent are neglected factors in distribution today.

There is something special about the plutocracy built up in recent decades. The rise of modern corporations comes from their being granted the rights of individual citizens by the US Supreme Court in 1884; and they now combine those rights with their long held special privileges, like limited liability for debt (Hart 2005). Even the Romans, not noted as champions of democracy, limited the spending of the rich on political campaigns. The US Supreme Court recently refused to accept any restriction on corporate political spending since it would infringe their “human rights” and allowed companies exemption from government rules on religious grounds.

These corporations once built their wealth by producing industrial commodities for profit at prices cheaper than their competitors. Now they rely on extracting rents (transfers sanctioned by political power) rather than on producing for profit in competitive markets. Thus “Big Pharma” makes more money from patents granted by Congress than the entire Medicare budget. Sony makes 75% of its revenues, not from selling machines, but from DVDs which are reproduced, almost without cost, from movies sold in cinemas; they call duplicating movies “piracy” (Johns 2009). Goldman Sachs retrieved from the US Treasury at full face value the $90 billion lost by insurance giant, AIG in the 2008 crash. These rent-seekers are not punished for stealing from the public, but are bailed out by our taxes and held up as shining examples of super-rich consumption to a public that has exchanged equal citizenship for bread and circuses (reality TV). This is decadence: there are no longer any national political solutions to economic problems that are global in scope.

Marx held that industrial capitalist profit subordinated rent and interest to its logic. This is why he and Engels thought that Victorian England held the future of the world economy. New phases of capitalist development and decline have been identified ever since. The American macro-economist, Dean Baker (2011) provides much insight into rentier capitalism in the US today. Selling stuff for profit means adding value through production. Rent-seeking is “…an attempt to derive economic rent by manipulating the social or political environment in which economic activities occur, rather than by adding value”. Rent and interest (banking) no longer take their scale, form, and function from industrial capitalist production for profit, as Marx insisted in Capital. Has the focus of political economy tipped away from industrial production (in the broadest sense) towards rents derived from political privilege? It is hard to see how the richest 1% could have done so well in the last four decades otherwise, given the overall stagnation of production and real wages in this period.

The digital revolution in communications is highly relevant, since many intangible commodities can now be copied easily at no cost. If you steal my cow, I can no longer milk it, but no-one loses out if I copy your song. Entertainment is the fastest-growing sector of the world economy after finance. National capitalism’s rise to dominance after the First World War is central to understanding today’s economic crisis, since it has been eroded since the early 1970s. Digital Retail Management regimes now being installed around the world illustrate the dominance of political and legal coercion in the economy now.

Rent-seeking now trumps value-added through production. The war over intellectual property escalates to ever higher levels of absurdity; and the rise of Big Tech, in extending corporate command and control, undermines our ability to make society in the interest of the American Empire. Like Marx and Engels, I believe that the machine revolution can be a force for greater economic democracy; but the open source and free software movements have lost the influence they once promised. Our main hope is to mobilise global networks to develop democracy, knowing that the multitudes are faster than they are. That was certainly David Graeber’s project.

David’s book is or will be the biggest best-seller by an anthropologist, even over Ruth Benedict’s Patterns of Culture (1934), the previous frontrunner. In 2011, he spent a sabbatical leave from Goldsmiths in New York where he was able to promote the book heavily before becoming a leading figure in the Occupy Wall Street movement. He was invited by the German President to debate on national television with the leader of the Social Democratic Party and Debt sold 30,000 copies there in two weeks. In the last two decades his books have been translated into many languages. He has a strong following in Japan, Korea, and China.

Debt’s phenomenal success was not an accident or freak of creative genius (Hart 2020, 2021). Anthropology narrowed its scope in the last century to meet the needs of academic bureaucracy and lost its public appeal in the process. David set out to write a big book with big ideas that allowed readers to place themselves in history. Anthropologists, in adopting fieldwork-based ethnography as their standard method, settled for narrow localism and a truncated version of their own history, finding in ethnography a replacement for racist colonial empire, while ignoring the fragmentation of world society into myopic nationalisms. David by-passed all this to resurrect the Victorian polymath and the world thanked him profusely for it. But there were other strings to his methodological bow, chief of them the ability to combine academic life with revolutionary politics when most of his colleagues were trapped in universities committed to bureaucratizing capitalism (Hart 2021). From the time he was a graduate student, he trained himself to write accessibly for the general public. He wrote each piece twice, once for himself and once for everyone else.

David’s intellectual success in a curtailed lifetime drew on self-conscious methods: vision, imagination and endurance through hardship, for sure; reading with no bounds; love of comparative ethnography; writing “to be understood rather than admired and not for knowing and over-acute readers” (Nietzsche); active participation in democratic politics; and returning to anthropology’s original mission as the study of humanity (Hart 2020). Call that genius, if you like; I prefer to call it a personal synthesis built on disciplined hard work over an extraordinary range of human activities. If only we could each aim to emulate him in some respects.

Keith Hart is Professor of Anthropology Emeritus at Goldsmiths, University of London and a full-time writer based in Paris and Durban. His research has been on economic anthropology, Africa, money, and the internet. Self in the World. Connecting Life’s Extremes will be published in Spring 2022.

This text was presented at David Graeber LSE Tribute Seminar on ‘Debt’.

References

Baker, Dean. 2011. The End of Loser Liberalism: Making markets progressive. Washington DC: Center for Economic and Policy Research.

Braudel, Fernand. 1975. Capitalism and Material Life. New York: Harper Collins.

Engels, Friedrich. 1972 [1884]. The Origin of the Family, Private Property, and the State. New York: Pathfinder.

Goody, Jack. 1976. Production and Reproduction. Cambridge: Cambridge University Press.

Goody, Jack. 2013. Metals, Culture and Capitalism: An essay on the origins of the modern world. Cambridge: Cambridge University Press.

Graeber, David. 2011. Debt: The first 5,000 years. Brooklyn, NY: Melville House.

Hart, Keith. 2002. World society as an old regime. In: C. Shore and S. Nugent (eds.), Elite Cultures: Anthropological perspectives. London: Routledge, 22-36.

Hart, Keith. 2005. The Hit Man’s Dilemma: Or business, personal and impersonal. Chicago: Prickly Paradigm Press.

Hart, Keith. 2006. Agrarian civilization and world society. In: D. Olson and M. Cole (eds.), Technology, Literacy and the Evolution of Society: Implications of the Work of Jack Goody. Mahwah, NJ: Lawrence Erlbaum, 29-48.

Hart, Keith. 2009. Money in the making of world society, C. Hann and K. Hart (eds.), Market and Society: The Great Transformation Today. Cambridge: Cambridge University Press, 91-105.

Hart, Keith. 2014. Jack Goody: the anthropology of unequal society. Reviews in Anthropology, 43(3): 199-220.

Hart, Keith. 2012. David Graeber and the Anthropology of Unequal Society. https://www.academia.edu/44225307/David_Graeber_and_the_Anthropology_of_Unequal_Society

Hart, Keith. 2020. David Graeber (1961-2020). https://www.academia.edu/44852890/David_Graeber_1961_2020_

Hart, Keith. 2021. Anthropology as a revolutionary project: David Graeber’s political legacy. https://www.academia.edu/48898491/Anthropology_as_a_revolutionary_project_David_Graebers_political_legacy

Hegel, Georg Wilhelm Friedrich. 2010 [1821]. The Philosophy of Right. Oxford: Oxford University Press.

Johns, Adrian. 2009. Piracy: The Intellectual Property Wars from Gutenberg to Gates. Chicago: University of Chicago Press.

Lévi-Strauss, Claude. 1969 [1949]. The Elementary Structures of Kinship. Boston: Beacon.

Marx, Karl. 1970 [1867]. Capital Volume 1. London: Lawrence and Wishart.

Morgan, Lewis H. 1964 [1877]. Ancient Society. Cambridge, MA: Belknap.

Piketty, Thomas. 2014. Capital in the Twenty-First Century. Cambridge, MA: Harvard University Press.

Polanyi, Karl. 2001 [1944]. The Great Transformation: The political and economic origins of our times. Boston: Beacon.

Rousseau, Jean-Jacques. 1984 [1754]. Discourse on Inequality. Harmondsworth: Penguin.

Sahlins, Marshall. 1958. Social Stratification in Polynesia. Seattle: University of Washington Press.

Tocqueville, Alexis de. 2004 [1859]. The Old Regime and the Revolution. Chicago: University of Chicago Press.

Weber, Max. 1961 [1922]. General Economic History. Piscataway, NJ: Transaction.

Weisweiler, John. Ed. 2022. Debt in the Ancient Mediterranean and Near East: Credit, Money and Social Obligation in David Graeber’s Axial Age (c.700BCE–700CE) Oxford: Oxford University Press.

Wolf, Eric. 1982. Europe and the People without History. Berkeley, CA: University of California Press.

Cite as: Hart, Keith. 2021. “Comment on Debt: The First 5,000 Years.” FocaalBlog, 20 December. https://www.focaalblog.com/2021/12/20/keith-hart-comment-on-debt-the-first-5000-years/